1. Introduction

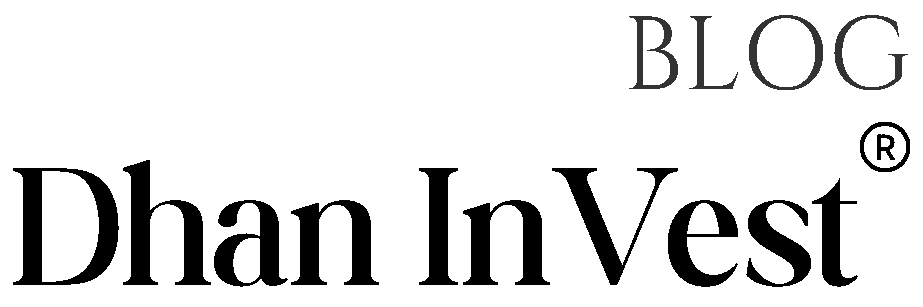

Dollar-Cost Averaging (DCA) is a popular investment strategy used by investors to reduce the impact of market volatility. By investing a fixed amount regularly, it allows you to buy more shares when prices are low and fewer when prices are high, leading to a more balanced approach over time.

2. What is Dollar-Cost Averaging (DCA)?

Dollar-Cost Averaging (DCA) is an investment strategy where an investor divides the total investment amount into equal parts and invests those parts at regular intervals, regardless of market conditions. The primary goal of DCA is to reduce the risk of making large investments at inopportune times, such as during market highs. Instead of investing a lump sum, DCA helps investors enter the market slowly and steadily, purchasing more shares when prices are low and fewer when prices are high.

This approach can be particularly beneficial in volatile markets, as it helps smooth out the effects of short-term price fluctuations. DCA is often used in mutual funds, stocks, ETFs, and other investment vehicles. The idea behind DCA is simple: over time, the price at which the investor purchases shares averages out, making the investment less sensitive to market timing.

3. How Does DCA Work in Practice?

3.1 How Dollar Cost Averaging (DCA) Works in Practice

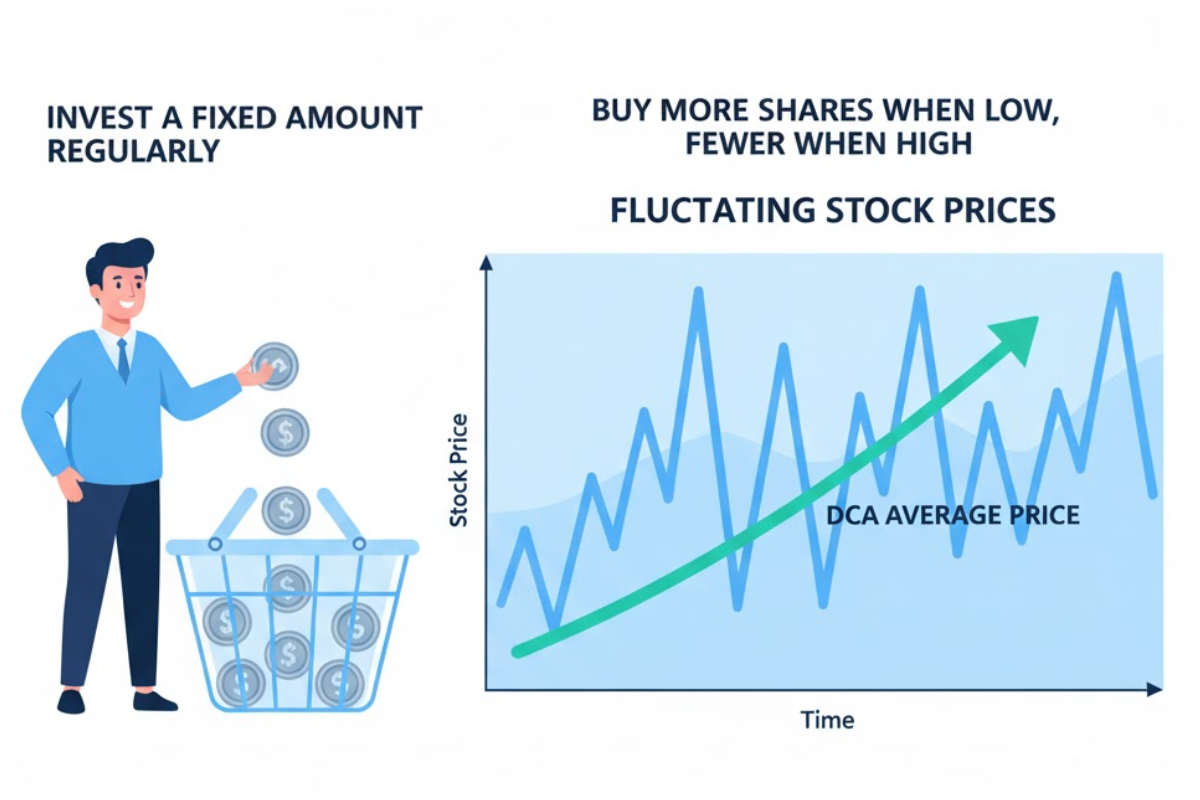

When you employ a DCA strategy, the key is regularity. The process is simple: you set an amount of money to invest (say $500) and invest it every month. No matter if the market is down or up, your investment stays the same. Over time, this allows you to buy more shares when prices are lower and fewer when they are high.

3.2 How Do You Use DCA?

To use DCA, first decide how much you want to invest over a set period—monthly, quarterly, etc. This could be any amount that fits your budget. For instance, you could set up a plan to invest $200 per month into an index fund. The beauty of DCA is that it’s automatic: the investment happens whether the market is up or down. By committing to invest a specific amount each time, you remove the emotional aspect of market timing, which often leads to poor decision-making.

3.3 What Happens When Prices Change?

The power of DCA is most evident when prices fluctuate. When prices fall, the fixed investment amount allows you to purchase more shares than when the market is high. Over time, this leads to a lower average cost per share. For instance, if you invest $500 a month in a stock, and the price of the stock drops, your $500 buys more shares. When prices rise, the same $500 buys fewer shares, but you’ve already accumulated shares at lower prices.

3.4 Simple Example

Imagine you decide to invest $500 monthly in a particular stock. In month one, the stock price is $100 per share. With your $500, you buy 5 shares. In the following month, the stock price drops to $50 per share. Now, you can buy 10 shares. By the third month, the price goes up to $150 per share, and your $500 buys only 3.33 shares. Over time, your average cost per share will be lower than if you had tried to time the market and invested a lump sum at one price.

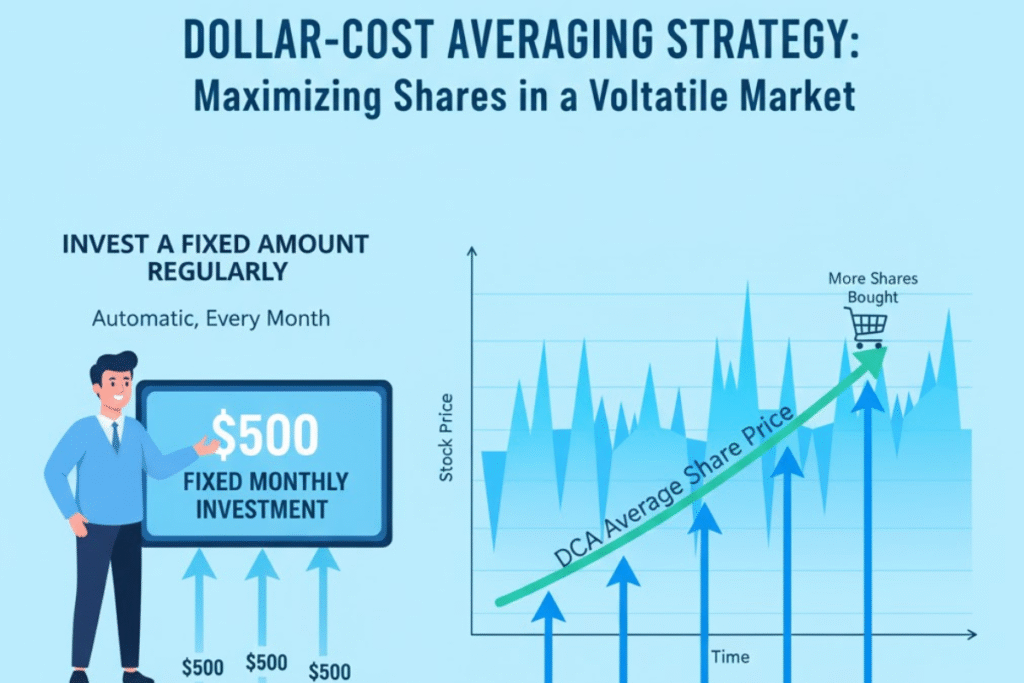

4. Dollar-Cost Averaging vs Lump Sum Investing

4.1 What is Lump Sum Investing?

Lump sum investing is the practice of investing a large amount of money all at once. This can be advantageous if the market is at a low point, as it allows you to purchase more shares when prices are cheaper. However, lump sum investing comes with higher risk because you could be investing when the market is at a high point, which might lead to poor returns.

4.2 Key Differences Between the Two Strategies

| Feature | Dollar-Cost Averaging (DCA) | Lump Sum Investing |

| Investment Timing | Spreads out over time, regardless of market conditions | Invests a large sum at once |

| Risk of Timing | Lower risk of poor timing due to gradual investment | Higher risk if invested at market peak |

| Market Conditions | Works well in volatile or uncertain markets | Best in a strong, bullish market |

| Average Cost | Average cost per share tends to be lower over time | Higher average cost if invested during a market high |

| Initial Investment | Requires only small, regular investments | Requires a large initial amount |

| Investor Psychology | Reduces emotional decision-making | Can lead to emotional decision-making due to market timing risks |

| Flexibility | High flexibility for small investors | Requires a large upfront commitment |

4.3 When to Use Dollar-Cost Averaging

DCA is particularly useful when you’re not sure about the best time to invest. It helps mitigate the risk of making a large investment during a market peak. It’s also a great strategy for beginners, as it simplifies the investment process and encourages regular investing habits.

4.4 When to Use Lump Sum Investing

If you have a lump sum of money to invest and the market is at a low point, lump sum investing may offer higher returns. However, this strategy requires a keen understanding of market conditions and the ability to tolerate potential volatility in the short term.

4.5 The Numbers: Which Strategy Actually Wins?

Studies have shown that lump sum investing typically outperforms DCA in the long term because the market tends to rise over time. However, this doesn’t mean DCA is a bad strategy. It simply depends on your risk tolerance and investment goals. If you’re unsure or the market is unpredictable, DCA provides a safer alternative.

4.6 The Psychology Factor: Why DCA Might Still Win

While lump sum investing might offer higher returns in the long run, DCA can reduce the psychological stress of market fluctuations. By investing steadily, you can avoid the emotional pitfalls of market timing, which can often lead to buying at the wrong time or selling out of fear during market dips.

5. Benefits of Dollar-Cost Averaging

5.1 Why It Works

DCA works because it allows investors to avoid the risk of making poor decisions based on market timing. By spreading out investments over time, you minimize the risk of investing too much money at the wrong time.

5.2 Key Benefits

- Reduces Timing Risk: DCA helps you avoid the mistake of investing a large sum at an inopportune time.

- Disciplined Approach: It encourages consistent, regular investing.

- Emotional Buffer: DCA removes emotions from the investment process by committing to automatic, regular investments.

5.3 Real-World Example

Let’s say you invest in an index fund using DCA. Over 10 years, you may see fluctuations in the market, but the consistent investing approach means you have more time to take advantage of dips and ride out market highs. In the end, your average cost per share is lower than if you had invested a lump sum at one point.

5.4 Simple Guidelines for Success

- Stay consistent: Set a regular investment schedule and stick to it.

- Be patient: DCA is a long-term strategy.

- Review your investments: Occasionally check that you’re still on track to meet your financial goals.

6. Common Mistakes to Avoid with DCA

6.1 Letting Emotions Take Over

DCA works best when it’s automated, but some investors may be tempted to adjust their contributions based on market conditions. Don’t let short-term market fluctuations dictate your strategy.

6.2 Only Investing When Markets Are Up

DCA should be consistent regardless of market performance. Don’t wait for the “perfect” time to invest.

6.3 Ignoring Portfolio Balance

While DCA focuses on buying regularly, it’s still important to balance your portfolio. Don’t keep investing in the same assets without considering diversification.

6.4 Skipping Regular Reviews

While DCA involves regular investing, you should still review your investments periodically to ensure they align with your financial goals.

6.5 Not Considering Costs

Some investment platforms charge fees, which can add up over time. Make sure to account for transaction fees and other costs when setting up your DCA strategy.

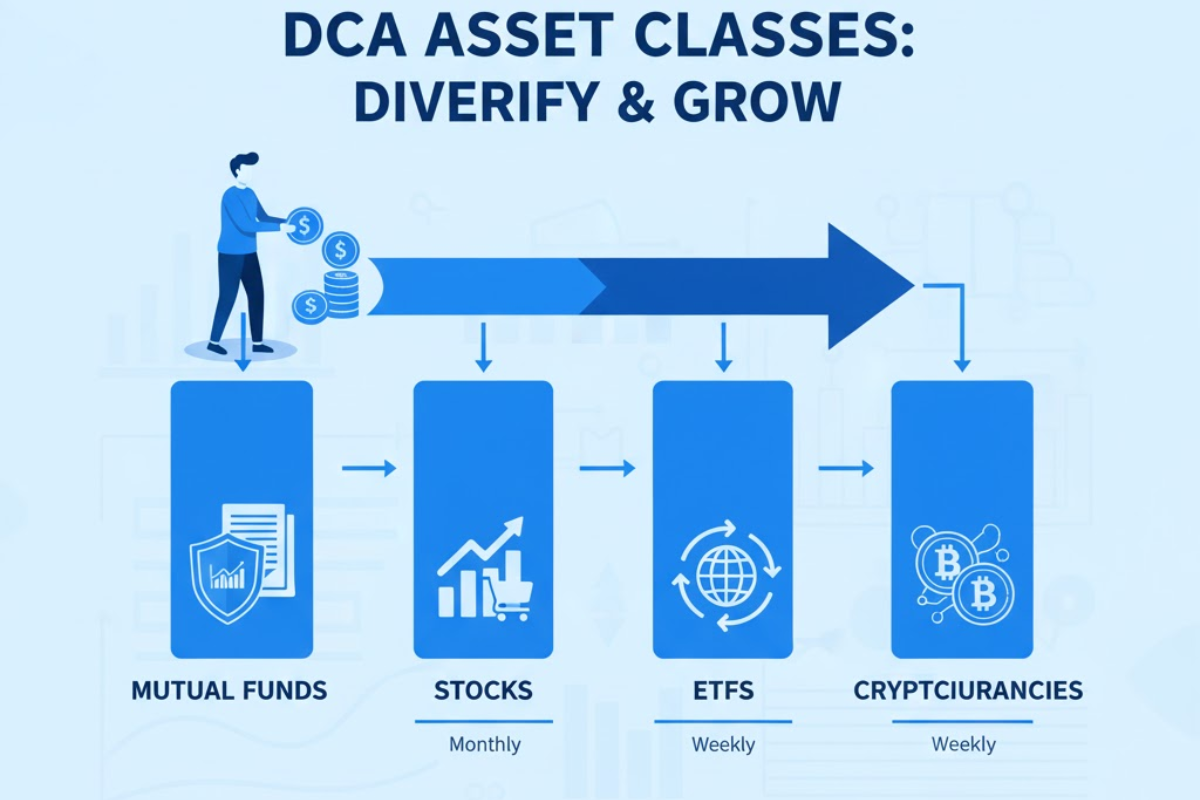

7. Types of Assets Suitable for DCA

DCA works well with various investment types, including:

7.1 Mutual Funds

Mutual funds allow you to invest in a diversified portfolio without needing to pick individual stocks. Many investors use DCA to invest in mutual funds regularly.

7.2 Stocks

DCA is often used for individual stocks, especially those with long-term growth potential.

7.3 Exchange-Traded Funds (ETFs)

ETFs are ideal for DCA because they offer diversification similar to mutual funds but with the flexibility of stocks.

7.4 Cryptocurrencies

Although more volatile, cryptocurrencies can also be suited for DCA if you’re willing to accept higher risks.

7.5 Bonds

For a more conservative DCA approach, bonds can provide steady returns and act as a buffer against stock market volatility.

7.6 Index Funds

Index funds are perfect for DCA because they track the market, allowing you to invest in a broad range of companies automatically.

8. How to Set Up a DCA Strategy?

8.1 Decide How Much Money to Invest Regularly

Start by deciding how much money you can commit to investing regularly. It could be $100 a month or $500 a quarter—whatever fits your budget.

8.2 Pick How Often to Invest

You can choose to invest weekly, monthly, or quarterly. Monthly is the most common choice for many investors.

8.3 Choose Your Investment

Select a mutual fund, ETF, or stock that you believe has long-term growth potential. Ensure it aligns with your risk tolerance and financial goals.

8.4 Use an Investment Platform

Many investment platforms allow you to set up automatic, recurring investments for DCA. Choose a platform that offers low fees and ease of use.

8.5 Automate Your Purchases

Once you’ve set everything up, automate your investments. This ensures that you stick to your strategy and avoid missing a month of investing.

8.6 Stick to Your Plan

The key to success with DCA is consistency. Even when the market is volatile, continue investing as planned. Over time, your patience will pay off.

9. Pros and Cons of DCA

| Pros | Cons |

| Reduces Emotional Decisions | Might Underperform in Bull Markets |

| DCA helps investors stick to a consistent plan without making decisions based on market volatility. | In a strong, rising market, lump-sum investing typically yields higher returns than DCA. |

| Reduces Risk of Poor Timing | Requires Patience |

| By spreading investments, DCA lowers the chances of buying at a market high. | DCA requires consistent, long-term commitment and patience, especially in volatile markets. |

| Simplicity and Ease | Potential for Higher Fees |

| DCA is simple to implement, particularly for beginners, and requires minimal intervention. | Some platforms charge transaction fees for regular purchases, which can add up over time. |

| Works Well in Volatile Markets | Might Limit Potential Returns |

| DCA helps to take advantage of market dips, making it effective in uncertain or fluctuating markets. | In a consistently rising market, DCA might not capitalize on growth as effectively as lump sum investing. |

| Automatic Investment | Requires Consistent Monitoring |

| Regular investments can be automated, making it easy for investors to stick to their plan. | Even though DCA is automated, you must review your investments periodically to ensure they’re on track. |

10. When Should You Use DCA?

10.1 Use DCA When You Are Unsure About the Best Time to Buy

If you don’t know when to invest, DCA helps you avoid the risk of market timing mistakes.

10.2 Use DCA to Avoid Investing a Large Lump Sum at Once

DCA helps you spread your investments over time, reducing the risk of investing during a market high.

10.3 Use DCA During Market Volatility or High Prices

During uncertain market conditions, DCA can help reduce the impact of price fluctuations.

10.4 Use DCA to Remove Emotion from Investing

By automating your investments, DCA reduces emotional reactions to market changes.

10.5 When DCA May Not Be Ideal

DCA may not be the best choice if you’re looking for high returns in a strong bull market, where lump sum investing could outperform.

11. Alternatives to DCA

There are other strategies you can use:

11.1 Lump-Sum Investing

Investing a large sum all at once, often used when market conditions are favorable.

11.2 Value Averaging (VA)

A more advanced strategy that involves adjusting your investments based on the target growth of your portfolio.

11.3 Systematic Investing or SIP

A systematic investment plan, similar to DCA, but often used in regions like India for mutual fund investments.

11.4 Enhanced Dollar-Cost Averaging (EDCA)

An enhanced version of DCA where investors increase or decrease their contributions based on certain market conditions.

11.5 Hybrid Approach

Combining DCA with lump sum investments to balance risk and return.

12. Expert Insights and Opinions

Dollar-Cost Averaging is a tried-and-tested strategy used by many successful long-term investors. Financial advisors recommend DCA for beginners and those who want to avoid the stress of market timing. However, while DCA is great for mitigating risk, it’s essential to balance your strategy with other investment approaches to optimize returns.

13. Frequently Asked Questions (FAQs)

Dollar-Cost Averaging involves investing a fixed amount at regular intervals, which reduces the risk of market timing.

DCA is a great strategy for beginners and those who want to reduce the risk of investing during market highs.

If you had invested $1000 in the S&P 500 10 years ago using DCA, you would have averaged out the price over time, potentially leading to a lower overall cost per share.

Yes, especially for those who prefer consistency and want to avoid emotional investing.

In crypto, DCA allows you to invest a fixed amount in cryptocurrencies at regular intervals, smoothing out the price fluctuations typical in the crypto market.Dollar cost averaging calculator?

A DCA calculator helps you estimate how your investments will perform over time based on a regular contribution amount.