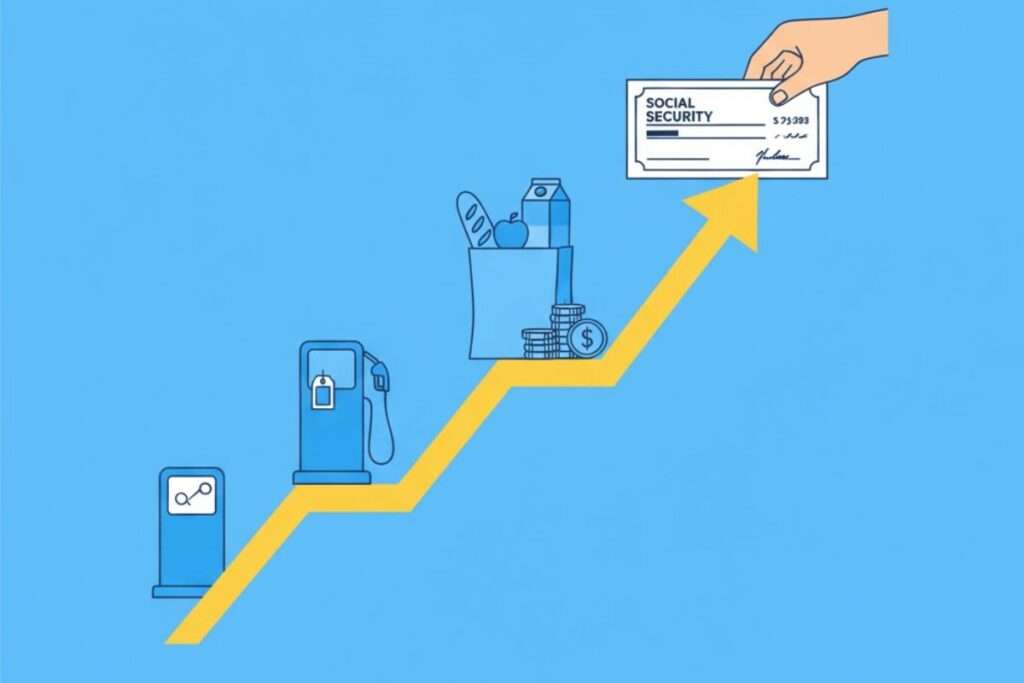

Social Security is one of the most important financial safety nets for millions of Americans. Each year, Social Security benefits are adjusted to account for changes in the cost of living, known as the Cost of Living Adjustment, or COLA. In this article, we’ll take a deep dive into the 2026 COLA increase and explain how it will affect Social Security recipients, retirees, and those with disabilities. Understanding this adjustment is crucial for planning your finances in 2026 and beyond.

2. What is Social Security COLA?

2.1 Explanation of COLA

COLA, or Cost of Living Adjustment, is an annual adjustment to Social Security benefits designed to help recipients keep up with inflation. The adjustment ensures that Social Security payments, including retirement benefits, disability payments, and Supplemental Security Income (SSI), maintain their purchasing power in the face of rising costs. Without COLA, the value of these payments would gradually erode as prices for goods and services rise.

2.2 How COLA Affects Social Security Benefits

Here’s how COLA impacts Social Security benefits:

- Inflation Protection: COLA ensures that the benefits increase in line with the rise in the cost of living.

- Automatic Adjustments: If the cost of living increases, the Social Security Administration (SSA) adjusts payments to match.

- Maintaining Purchasing Power: Without COLA, recipients would find it harder to afford basic necessities like food, transportation, and healthcare.

2.3 Purpose of Adjusting Benefits with Inflation

The main goal of COLA is to ensure that Social Security benefits keep pace with inflation. Here’s why this is so crucial:

- Purchasing Power: Without COLA, inflation would quickly reduce the value of Social Security checks.

- Protection for Recipients: COLA allows Social Security recipients to maintain their standard of living despite rising costs.

3. How Does COLA Impact Social Security Benefits in 2026?

3.1 Overview of Expected COLA Increase for 2026

In 2026, Social Security recipients are set to see a 2.8% COLA increase. This increase is important for helping people keep up with rising living costs.

Here’s an example of how the increase works:

| Current Social Security Benefit | 2026 COLA Increase (2.8%) | New Monthly Benefit |

| $1,000 | $28 | $1,028 |

| $2,000 | $56 | $2,056 |

| $3,000 | $84 | $3,084 |

3.2 Factors Influencing COLA Rates in 2026

Several factors play into determining the COLA rate for Social Security:

- Consumer Price Index (CPI): The CPI tracks inflation based on a typical basket of goods and services.

- Economic Trends: Changes in the economy, such as employment rates and wage growth, can affect the COLA calculation.

- Government Policies: Actions like monetary policies and fiscal decisions can influence inflation rates, and by extension, COLA.

3.3 Predictions and Expert Insights for 2026

The expected 2.8% COLA increase for 2026 reflects a moderate rise in inflation. Experts predict this will help maintain purchasing power for Social Security recipients but caution that long-term inflationary pressures could make future increases necessary.

For more insights on how inflation impacts economic conditions, check out this article on Best AI Stocks.

4. Why is COLA Important for Social Security Recipients?

4.1 Protecting Against Inflation

Without COLA, Social Security benefits would lose value over time due to inflation. The 2.8% COLA increase in 2026 helps protect recipients from this loss of purchasing power.

4.2 Ensuring Retirees Maintain Purchasing Power

For retirees, Social Security often represents the largest portion of their income. Without adjustments for inflation, retirees would struggle to afford necessities. COLA helps bridge this gap, making sure retirees don’t lose out financially as prices increase.

4.3 The Role of COLA in Long-Term Retirement Planning

Incorporating COLA into long-term retirement planning is crucial. It allows you to:

- Anticipate changes in income: As Social Security benefits increase with COLA, your retirement income grows accordingly.

- Plan for inflation: COLA adjustments ensure you are somewhat protected against rising costs throughout retirement.

For further retirement tips, check out this article on Budgeting Money.

5. Factors That Affect Social Security COLA

5.1 Inflation and Consumer Price Index (CPI)

The Consumer Price Index (CPI-W) is a key factor in determining COLA. This index tracks the prices of goods and services commonly purchased by urban workers. If the CPI rises, Social Security benefits rise as well. Here’s a quick look at how inflation affects COLA:

- If the CPI rises: Social Security benefits increase to match the rising costs.

- If the CPI falls or stays the same: COLA may not apply, meaning benefits remain unchanged.

5.2 Economic Trends and Government Policy

Economic conditions such as changes in unemployment, wage growth, and overall economic growth can influence inflation. Additionally, government policies, like changes in tax rates or fiscal stimulus programs, can also affect COLA adjustments.

For more on how government decisions influence inflation, explore this article about the Government Shutdown.

5.3 How COLA Rates Are Calculated

Here’s how the SSA determines COLA:

- Track the CPI-W: The SSA monitors changes in the CPI-W, the index that measures inflation.

- Calculate the Increase: If inflation rises, benefits increase based on the percentage change in the CPI-W.

- Annual Adjustment: This is done annually, with the new COLA being announced each October.

6. How to Plan for Social Security Benefits with COLA in Mind

6.1 Budgeting for Potential Increases in Benefits

When planning your finances, it’s important to account for potential COLA increases. Here are some tips:

- Anticipate the 2.8% increase: Expect a 2.8% COLA increase for 2026. Use this to adjust your monthly budget.

- Consider healthcare costs: Healthcare often rises faster than inflation, so you may need to adjust your budget accordingly.

- Monitor updates: Keep an eye on COLA announcements, as they can fluctuate based on inflation.

For a deeper dive into budgeting, check out this guide on Budgeting Money.

6.2 Impact on Retirement Planning Strategies

Incorporate COLA into your retirement planning by:

- Adjusting for inflation: Include the possibility of COLA increases when projecting future retirement income.

- Considering other income sources: Social Security alone may not be enough. Explore other retirement income sources, like pensions or investments.

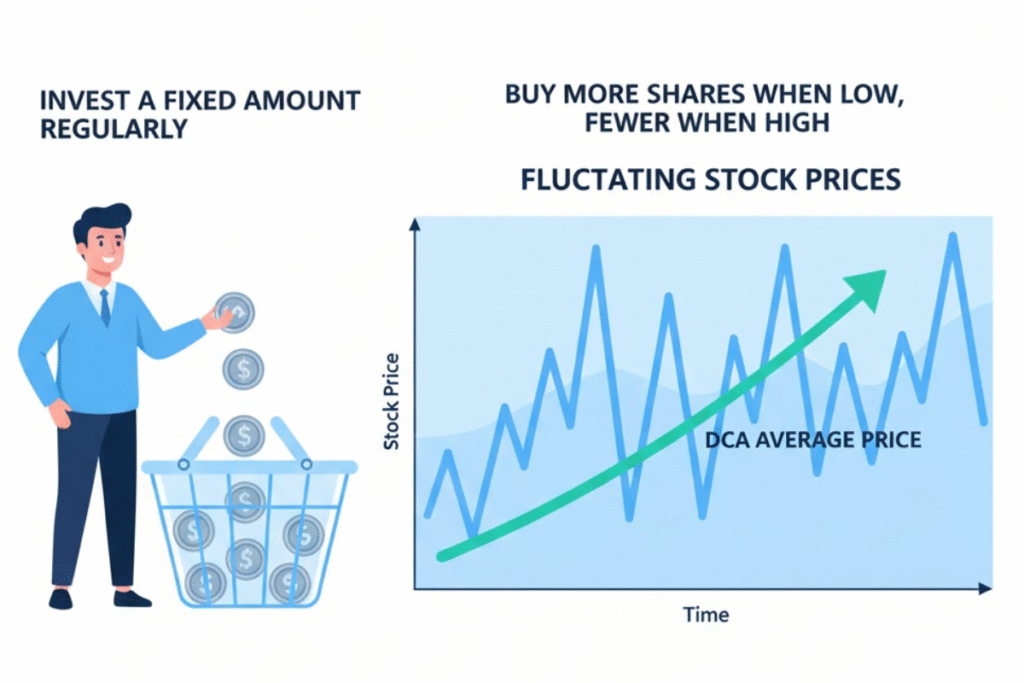

For tips on smart investing, see this post on Dollar-Cost Averaging.

6.3 Diversifying Income Sources Alongside COLA Adjustments

While COLA provides some inflation protection, it’s wise to diversify your income sources. Here’s why:

- Stocks and bonds: Investments can help protect your purchasing power if COLA doesn’t fully keep up with inflation.

- Real estate: Rental income or property appreciation can also help boost your financial security.

7. Benefits of Social Security COLA for Different Demographics

7.1 Retirees and Seniors

Social Security is a lifeline for retirees. The 2.8% COLA increase for 2026 will help seniors afford basic needs like:

- Food

- Healthcare

- Transportation

7.2 Disabled Individuals Receiving Social Security

Disabled individuals receiving Social Security benefits will also see the 2.8% COLA increase in 2026. This ensures that their benefits keep pace with inflation, maintaining their ability to live independently.

7.3 Impact on Lower-Income vs. Higher-Income Recipients

For lower-income recipients, COLA is especially important because a larger portion of their income goes to essential goods and services. Higher-income recipients may not feel the same level of impact, but COLA still helps them maintain their standard of living.

8. Common Misconceptions About Social Security COLA

8.1 Misunderstandings About the Timing of COLA Changes

- Common myth: COLA increases are automatic every year.

- Reality: COLA changes are based on inflation rates and can vary from year to year. Announcements are typically made in October.

8.2 The Myth of Automatic, Large Increases

- Common myth: COLA increases are large every year.

- Reality: While COLA provides increases, they are often modest, with a 2.8% increase in 2026 being typical.

8.3 Clarifying COLA’s Real Impact on Financial Security

COLA is important, but it doesn’t guarantee financial security. It helps, but recipients should plan for other sources of income to manage long-term financial needs.

9. What to Expect from Social Security in 2026: COLA vs. Other Changes

9.1 Other Potential Adjustments to Social Security Benefits

- Full retirement age: Changes to the full retirement age could impact your benefits.

- Social Security tax cap: Adjustments to the tax cap can also affect the funding of Social Security.

9.2 Future Trends in Social Security Funding

The future of Social Security may involve policy changes as the program faces long-term funding challenges. Understanding how COLA fits into broader changes can help you plan better.

9.3 How COLA Fits Into Broader Changes in 2026

While COLA helps keep benefits in line with inflation, it’s important to consider other factors, such as economic conditions and policy changes, that may affect your benefits in the long term.

10. Frequently Asked Questions (FAQs)

The 2.8% COLA increase will raise Social Security benefits, providing extra monthly income to help combat inflation.

For 2025, the COLA increase was 3.2%, providing a boost to benefits for that year.

A 2.8% increase on a $1,000 benefit would mean an additional $28 per month.

To receive $3,000 a month, you typically need to have a higher earnings history or additional income sources like pensions or investment returns.