1. Introduction

As the possibility of a government shutdown in 2025 becomes more likely, many wonder how it will affect personal finances, investments, and the overall economy. While a government shutdown is primarily a political issue, its economic impacts can be felt across the board. In this article, we’ll break down what a government shutdown is, why it might happen in 2025, and how you can protect your financial well-being during this uncertain time.

2. What is a Government Shutdown?

A government shutdown occurs when Congress fails to pass a funding bill for the federal government, causing a temporary closure of many government agencies and services. Without a budget in place, non-essential services cease, and federal employees are either furloughed or forced to work without pay.

Historical Context: Shutdowns aren’t a new phenomenon. The longest shutdown in U.S. history occurred from December 2018 to January 2019, lasting 35 days. This shutdown affected approximately 800,000 federal workers and led to disruptions in services such as tax filings and national parks. The 2013 shutdown, lasting 16 days, resulted in a loss of $24 billion to the economy.

| Shutdown Year | Duration | Cost to Economy |

| 2013 | 16 days | $24 billion |

| 2018-2019 | 35 days | $11 billion |

3. Why is the Government Shutting Down in 2025?

In 2025, a potential shutdown could be triggered by ongoing political gridlock. At the heart of the issue is budgetary disputes, with lawmakers unable to agree on how to allocate funds. Some key factors include:

- Political Tensions: Bipartisan disagreements on how to handle spending for defense, social programs, and infrastructure.

- Fiscal Policy: The rising national debt and budget deficits could cause lawmakers to push for more austerity measures or, conversely, demand increased spending in key areas.

- Immigration and Health Policy: Specific bills regarding border security and healthcare reform could also contribute to the deadlock.

With political divisions deepening, the shutdown could occur as Congress fails to pass crucial spending legislation, affecting not only federal employees but also a range of public services.

4. How Will a 2025 Government Shutdown Affect the Economy?

4.1 Short-term Economic Impacts

A government shutdown brings immediate disruptions. Some of the key short-term effects include:

- Federal Workers and Contractors: With many federal employees furloughed, thousands of workers will not be paid, leading to a temporary loss of income. Contractors and small businesses that rely on government contracts may also face delays.

- Government Services: Services such as social security and disaster relief may experience delays, causing significant inconvenience for citizens relying on them.

- Consumer Confidence: When the government is shut down, people often feel uncertain about their financial future. This uncertainty can lead to reduced consumer spending, which harms economic growth.

4.2 Long-term Economic Risks

Beyond the immediate effects, a prolonged shutdown can cause more lasting damage, including:

- Delays in Government Projects: Projects related to infrastructure, research, and public health may experience delays. This not only impacts job growth but also hinders long-term economic growth.

- GDP Growth: The cumulative effect of prolonged shutdowns can slow GDP growth, as public sector investments and programs are delayed or canceled.

- International Trade: Government shutdowns can delay or even halt key functions like customs inspections and trade agreements, disrupting global supply chains.

A prolonged shutdown sends a signal of instability, which may reduce foreign investments and affect overall economic confidence.

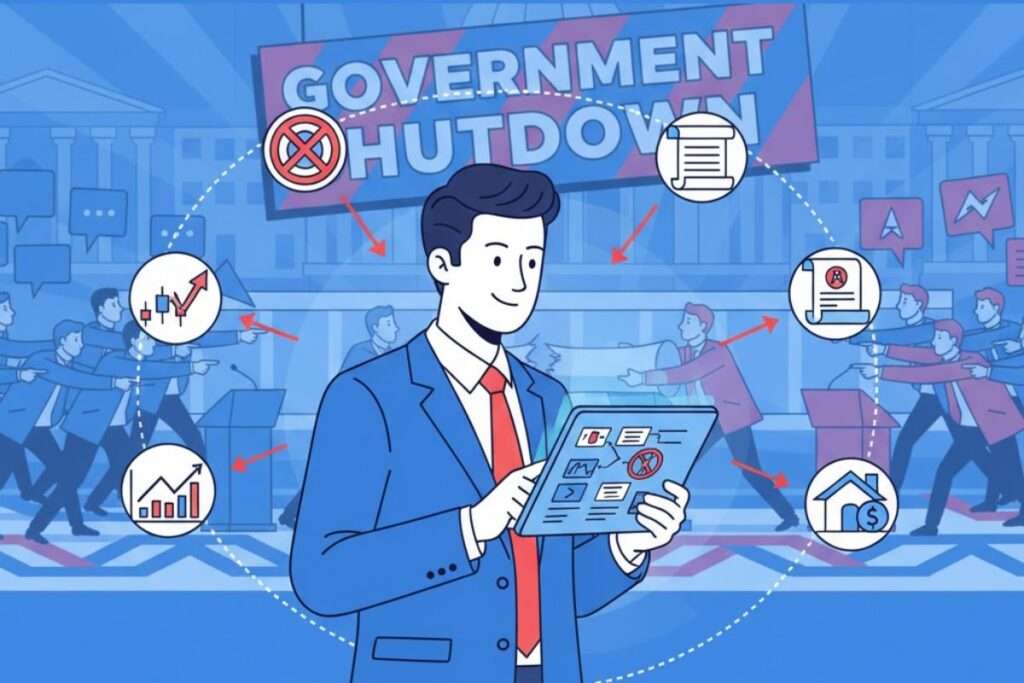

5. The Financial Implications of a Government Shutdown

5.1 Stock Market Reactions

The stock market typically reacts negatively to the uncertainty caused by a government shutdown. Increased market volatility is common as investors are wary of the long-term effects on the economy. However, some sectors may benefit, especially those tied to government contracts or defense.

| Sector | Impact During Shutdown |

| Defense | Potential gains |

| Healthcare | Possible stability |

| Technology | Likely unaffected |

| Retail and Consumer | Negative impact |

5.2 Impact on Interest Rates and Inflation

The financial implications of a shutdown also include changes to interest rates and inflation:

- Interest Rates: The government’s increased need for borrowing during a shutdown can lead to higher interest rates. With more debt issued, borrowing costs for businesses and consumers could rise.

- Inflation: Shutdowns can disrupt the supply chain, leading to shortages and higher costs for goods, contributing to inflation. The Federal Reserve may need to act more aggressively to control rising prices.

6. How to Protect Your Investments During a Government Shutdown

6.1 Diversification Strategies

To protect your investments during a government shutdown, one key strategy is diversification. By spreading your investments across stocks, bonds, real estate, and commodities, you lower the risk that one sector’s downturn will significantly affect your overall portfolio. During uncertain times, diversify into defensive stocks, such as utilities and consumer staples, that tend to perform well during market volatility.

6.2 Consider Defensive Stocks

Certain types of stocks, known as defensive stocks, are typically less sensitive to economic cycles. These stocks belong to sectors like healthcare, utilities, and consumer goods, which provide essential services. Even during a government shutdown, demand for these products remains relatively steady, making defensive stocks a safer investment.

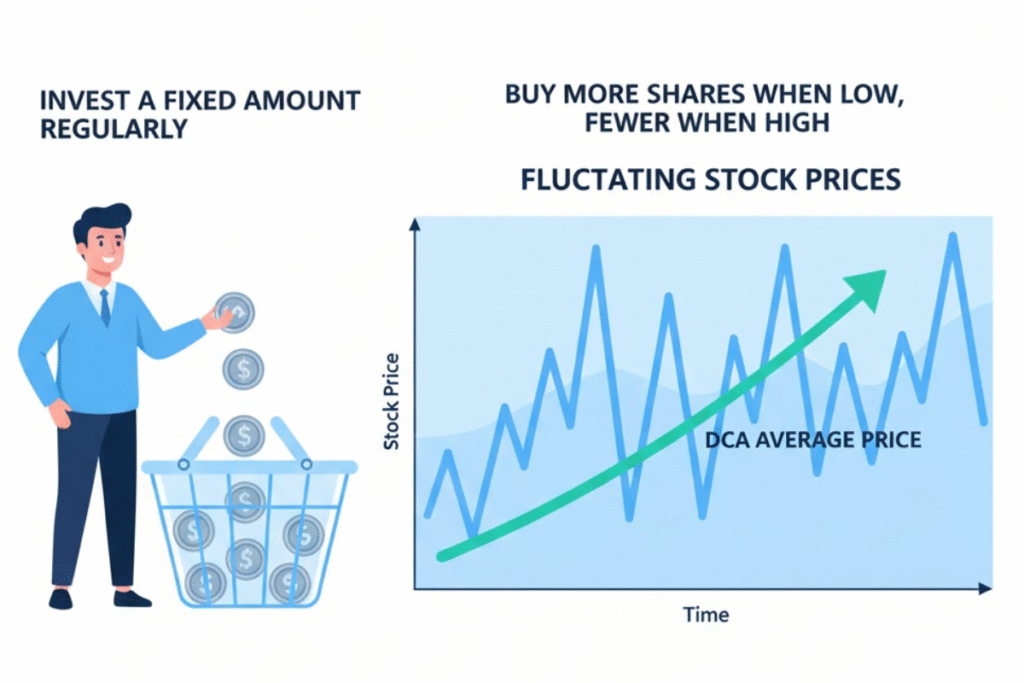

For more on how to build a resilient portfolio, read about Dollar-Cost Averaging, a strategy that can help reduce the impact of market volatility.

7. Potential Benefits of a Government Shutdown for Investors

7.1 Opportunities in Gold and Precious Metals

Gold and other precious metals often perform well during times of political uncertainty, like a government shutdown. These assets are seen as safe havens, meaning investors flock to them when stock markets are unstable. Gold tends to increase in value when confidence in government-backed currencies falters, which makes it an appealing investment during a shutdown.

7.2 Sector-Specific Growth

While some industries will struggle during a shutdown, others may see growth. For instance, defense contractors may benefit from increased government spending on security. Healthcare companies, especially those tied to government healthcare programs like Medicare, could also see increased demand.

Additionally, technology companies that provide services to the public sector may benefit, as governments look to modernize their systems during a shutdown.

8. Historical Case Studies: Government Shutdowns and Their Aftermath

8.1 2013 Government Shutdown Impact

In the 2013 government shutdown, lasting 16 days, $24 billion was lost to the economy. Services were halted, and nearly 800,000 federal employees were furloughed. The shutdown slowed GDP growth and decreased consumer spending. However, stock markets rebounded relatively quickly after the shutdown ended, highlighting the resilience of the broader economy.

8.2 1995–1996 Government Shutdown Impact

The 1995–1996 government shutdown lasted 21 days and was caused by a budget disagreement between President Bill Clinton and a Republican-controlled Congress. Despite the disruptions, the market eventually recovered, and the economy continued to grow. The shutdown is remembered for its political consequences, but its long-term economic effects were less severe than initially feared.

9. How to Prepare for a Possible Government Shutdown in 2025

9.1 Building a Financial Safety Net

Emergency savings are crucial during times of uncertainty, especially when a government shutdown is imminent. Experts recommend setting aside three to six months’ worth of expenses in an easily accessible savings account. This financial cushion will help cover unexpected costs during a shutdown, such as delayed payments or furloughed wages.

Check out our guide on Budgeting Tips to learn how to build your safety net.

9.2 Reevaluating Investment Portfolios

Reevaluating your investment portfolio before a potential shutdown can help minimize risk. Look for assets that are defensive in nature and consider shifting away from more volatile investments. Be sure to diversify across various sectors, and consider rebalancing your portfolio to focus on stability during this period of uncertainty.

10. Frequently Asked Questions (FAQ)

The government shutdown in 2025 may happen due to disagreements between political parties over key budgetary issues. Fiscal policy debates, national debt concerns, and spending priorities could trigger the shutdown.

A government shutdown happens when Congress fails to approve a funding bill, causing federal agencies and services to halt operations temporarily.

President Trump initiated a shutdown in 2018-2019 that lasted 35 days, primarily over funding for the U.S.-Mexico border wall.

The Obama administration faced a shutdown in 2013 due to disagreements about funding the Affordable Care Act and the federal budget.