Managing money can feel like learning a new language, especially when you’re just starting out. Whether you’re fresh out of school, new to adulting, or simply looking to get a better grip on your finances, budgeting is the key to taking control of your money. The good news is, budgeting doesn’t have to be complicated. In fact, it’s one of the most straightforward ways to build a stable financial foundation. This guide will walk you through 10 proven ways to budget money for beginners, offering practical tips, expert insights, and clever ways to save money—no matter where you start.

1. Introduction

You don’t need to be a financial expert to make budgeting work for you. In fact, the basics to any budget are easy to understand and can be broken down into manageable steps. With a little time, patience, and consistency, you can develop smart money habits that will pay off in the long run. From tracking your spending to building an emergency fund, budgeting helps you understand where your money is going and how to make your dollars work harder.

Let’s jump right into the top 10 brilliant money-saving tips that will get your budget on track.

2. Set Clear Money Goals

Before you start planning your budget, it’s essential to know exactly why you’re budgeting. What are you saving for? Do you have debt to pay off? Are you looking to build an emergency fund, buy a car, or start investing? Setting clear money goals gives you direction and motivation as you build your budget.

2.1 Short Term Targets

Short-term targets might include paying off credit card debt, building up your savings, or saving for a vacation. These are goals you can achieve in a few months to a year. Being clear about your short-term financial goals helps you focus your spending and saving habits.

2.2 Long Term Dreams

Long-term goals are things like saving for retirement or a down payment on a house. These goals will take several years to achieve, but they provide a big-picture perspective. Long-term dreams help you stay motivated during the tougher months when saving feels hard.

3. List All Income

It’s impossible to create a realistic budget without knowing exactly how much money you’re bringing in each month. Make sure you have a clear understanding of all the income sources that come into your bank account.

3.1 Regular Paychecks

This is the income you get from your full-time job or primary employment. Knowing your after-tax pay helps you determine what you have to work with each month.

3.2 Side Hustle Cash

In today’s world, many people have additional streams of income, like a side hustle or freelance work. If you’re one of those, add these extra funds into your budget. Clever ways to save money, like having a side gig, can boost your savings and create more room in your budget for future goals.

4. Track Every Expense

Tracking every expense is crucial for anyone just starting a budget. Knowing where your money is going gives you control over your financial situation. This might sound like a tedious task, but it’s one of the most valuable habits you can form.

4.1 Daily Spend Log

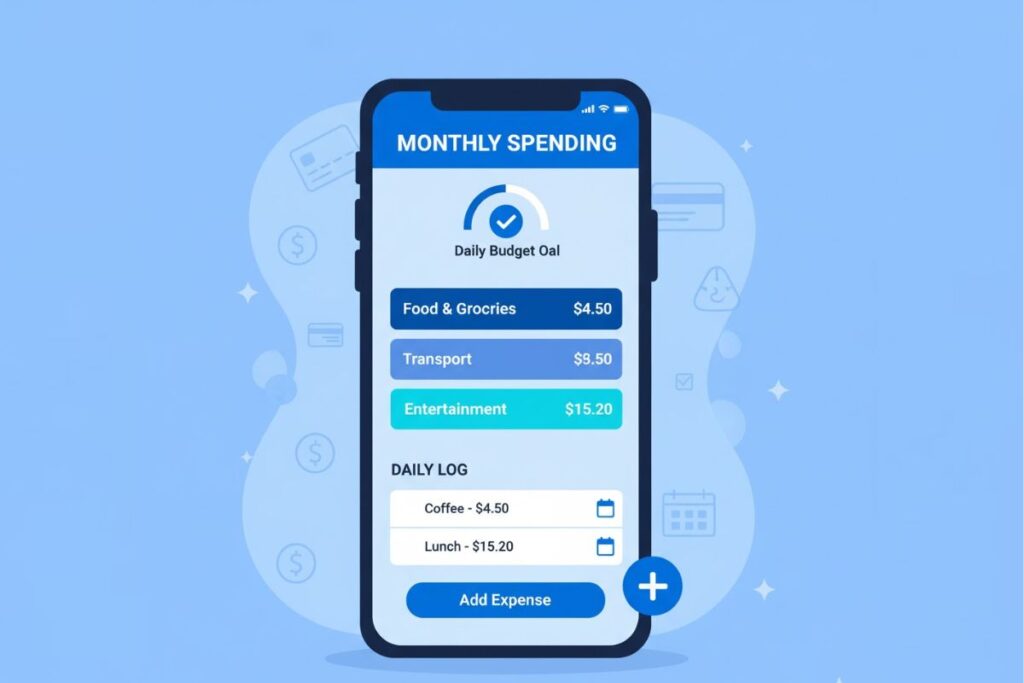

You don’t have to track every penny, but keeping a daily log of what you spend can help you identify patterns. Apps like Mint or YNAB (You Need A Budget) make this easier by categorizing your spending automatically.

4.2 Weekly Review

At the end of each week, take a few minutes to go over your spending. Are there any unexpected expenses? Did you overspend in any area? A quick weekly review will keep you on top of your finances and help you make adjustments before it’s too late.

5. Separate Needs and Wants

This is one of the most important lessons in budgeting—learning to differentiate between what you need and what you want. It’s easy to confuse the two, especially when you’re trying to balance comfort and financial discipline.

5.1 Fixed Essentials

Needs are your non-negotiables. These are your rent or mortgage, utilities, groceries, transportation, and other essential bills. These costs should be prioritized in your budget because you cannot live without them.

5.2 Flexible Extras

Wants, on the other hand, are the things that make life more enjoyable but aren’t necessary for survival. This includes dining out, entertainment, shopping, and subscriptions. While these things add value to your life, they’re the first areas where you can cut back to save money when needed.

6. Pick a Budget Plan

Choosing a budgeting method that suits your style and goals is essential. There are several different approaches you can take, so find the one that works best for you.

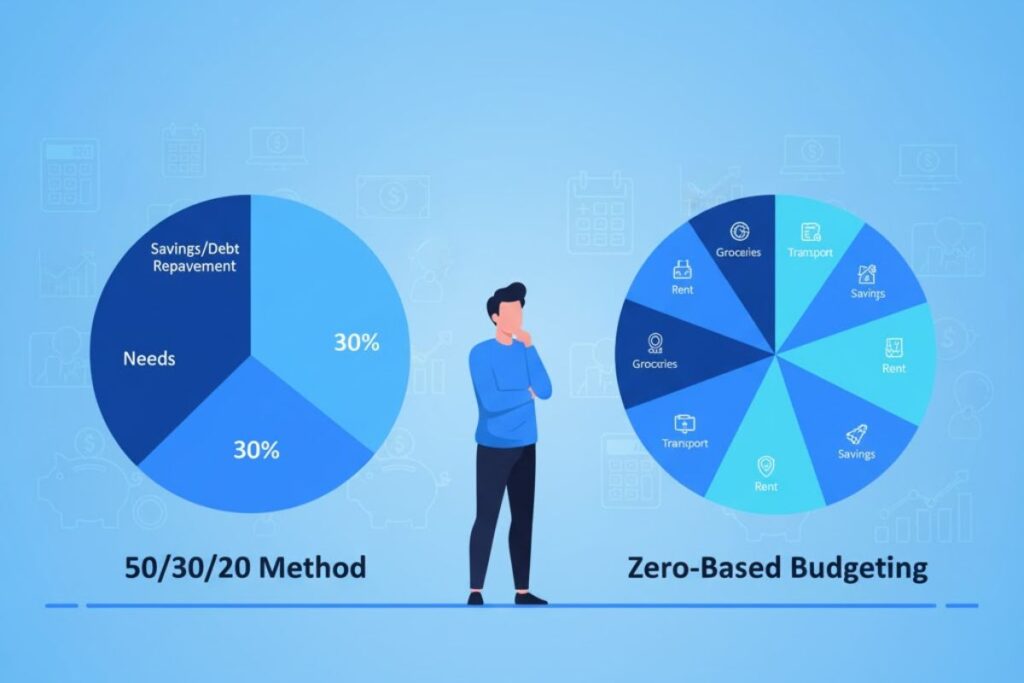

6.1 50/30/20 Split

This is one of the easiest and most popular methods. It divides your income into three categories:

- 50% goes to your needs (rent, utilities, food, etc.)

- 30% goes to wants (entertainment, dining out, shopping)

- 20% goes to savings and debt repayment

This method provides a balanced approach and is flexible enough for most people.

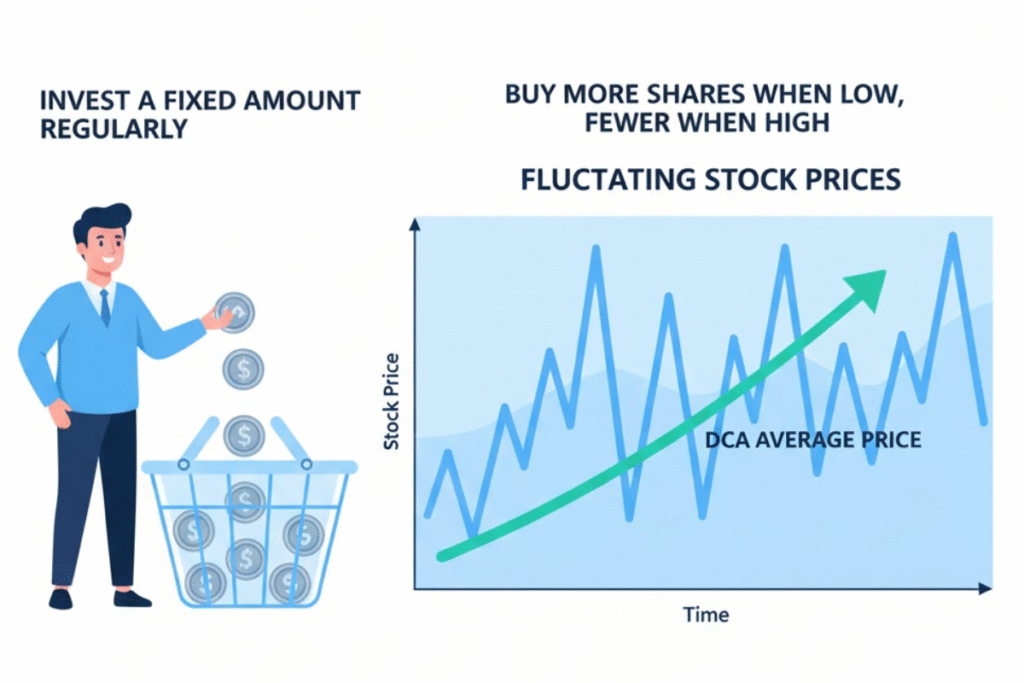

6.2 Zero-Based Style

In this method, you allocate every dollar of your income to a specific expense or savings goal. The goal is to have zero leftover by the end of the month. This forces you to be intentional with your spending and ensures that every dollar is working towards a purpose.

7. Automate Your Savings

One of the best ways to save money fast on a low income is to automate your savings. When you set up automatic transfers, it becomes easier to save without even thinking about it.

7.1 Pay Yourself First

Before you start paying bills or buying things, set aside a portion of your income for savings. This can be as simple as having a set amount deducted from your paycheck each month. By prioritizing savings first, you ensure that your future self benefits.

7.2 Use Auto Transfers

Set up auto transfers from your checking account to a savings account right after each payday. This removes the temptation to spend that money and builds your savings over time.

8. Cut Hidden Fees

You’d be surprised how much money you can save by cutting unnecessary fees. These sneaky charges can quickly drain your budget.

8.1 Bank Charges

Many banks charge monthly maintenance fees, ATM fees, or overdraft fees. Switching to a fee-free checking account or making sure you don’t overdraft your account can save you a substantial amount each year.

8.2 Late Payment Fees

Late fees can pile up quickly, especially if you miss a credit card or bill payment. Set up reminders or automate payments to avoid these charges. Not only will this save money, but it’ll also help improve your credit score over time.

9. Plan for Big Costs

Life is full of big expenses that don’t occur every month, but that doesn’t mean you can’t plan for them.

9.1 Car Repairs

Car repairs, maintenance, or replacements can be expensive. Set aside a small amount each month for these inevitable costs. Having a “Car Repair Fund” can help you avoid scrambling for money when the unexpected happens.

9.2 Annual Subscriptions

Subscriptions for things like streaming services, gym memberships, or insurance are often billed annually. Budget for these costs by breaking down the yearly amount into monthly portions and saving for them in advance.

10. Build an Emergency Fund

An emergency fund is one of the best ways to ensure that unexpected financial events don’t throw off your entire budget.

10.1 Starter $1,000

A common goal for beginners is to have at least $1,000 in an emergency fund. This gives you a safety net for minor emergencies like car repairs, medical bills, or job loss.

10.2 Three-Month Cushion

Once you’ve reached your initial $1,000, work towards saving three months’ worth of living expenses. This larger cushion will help you navigate bigger financial storms.

11. Review and Adjust

Budgeting isn’t a one-time task. It’s something you need to review and adjust regularly to make sure it’s working.

11.1 Monthly Check-In

At the end of each month, go over your spending, savings, and goals. Did you stick to your budget? If not, what went wrong? Adjust your budget for the next month accordingly.

11.2 Yearly Reset

Once a year, take a more in-depth look at your budget. Have your income or expenses changed? Are your goals still aligned with your financial situation? This yearly reset allows you to make necessary adjustments and stay on track.

12. Beginner Budget Tools

Fortunately, there are plenty of free and easy-to-use tools that can help you manage your budget more effectively.

12.1 Free Spreadsheets

If you enjoy working with numbers, creating a budget spreadsheet might be the best option for you. Google Sheets and Excel offer free templates that are easy to customize.

12.2 Budgeting Apps

For a more automated approach, there are several apps that can help you track your expenses and stick to your budget. Some popular ones include Mint, YNAB, and PocketGuard.

13. Common Pitfalls

As with any new habit, there are a few common mistakes that beginners often make.

13.1 Unreal Goals

Setting unrealistic financial goals can set you up for disappointment. It’s important to set goals that are achievable and in line with your current financial situation.

13.2 Ignoring Small Buys

Small purchases add up quickly. If you aren’t careful, a daily coffee habit or frequent online shopping can derail your budget. Pay attention to the little expenses, as they can make a big impact.

14. Conclusion

Budgeting is not a one-size-fits-all activity, but by following these 10 proven strategies, you can create a plan that fits your lifestyle and goals. Whether you’re just getting started with budgeting or looking to refine your existing plan, the tips in this guide can help you make smarter financial decisions and take control of your money. With a little planning, tracking, and tweaking, you’ll be on your way to financial success in no time.

By practicing these steps consistently, you’ll be well on your way to achieving your financial goals and securing a more stable future.

Key Budgeting Steps

Here’s a quick reference table to summarize the essential actions in building your budget:

| Step | Action |

|---|---|

| Set Clear Money Goals | Identify short-term and long-term financial goals |

| List All Income | Calculate total income from all sources |

| Track Every Expense | Log all spending to track where money goes |

| Separate Needs and Wants | Distinguish between essential and non-essential expenses |

| Pick a Budget Plan | Choose a budgeting plan (e.g., 50/30/20 or zero-based) |

| Automate Your Savings | Set up automatic transfers for savings |

| Cut Hidden Fees | Avoid unnecessary bank fees and late charges |

| Plan for Big Costs | Save for irregular expenses like car repairs and subscriptions |

| Build an Emergency Fund | Start with a $1,000 emergency fund and grow it to three months’ worth |

| Review and Adjust | Review your budget monthly or annually to make adjustments |

This table provides a simple overview to guide you as you take action on these key budgeting steps. Keep it handy to stay organized and motivated as you work towards your financial goals.